Creation date : 15/10/2018

New rights for the self-employed and the liberal professions

Until now, these benefits were only available to employees. For the sake of equality, the Grand Duchy passed the law of 1 August 2018.

Authorised in advance by the General Inspectorate of Social Security (IGSS), these new schemes are proposed by a promoter, i.e. a group of independent professionals, an insurer or a pension fund manager.

Why this new law?

The pension system in Luxembourg is now under pressure and social security will soon be confronted with an ageing population and a whole series of consequences.

The extension of this savings opportunity to the self-employed and the liberal professions is one of the reforms introduced by the Government to raise taxpayers' awareness of building up supplementary retirement savings.

As a reminder, the Luxembourg pension system is based on three pillars: the first being the state pension, the second the supplementary pension scheme offered to employees and now to the self-employed and the liberal professions, and the third corresponding to private savings (old age insurance). / Article 111Bis LIR, etc.).

"I am well aware that my state pension will not be enough to allow me to maintain my current standard of living. I am very satisfied with this new law which gives me the opportunity to build up capital for my retirement on advantageous terms, in the same way as many employees in Luxembourg" enthuses Benjamin, a lawyer specialising in family law.

This is an attractive solution if you have capacity for savings

Let us not forget that the supplementary pension scheme is above all a retirement savings solution to which the legislator has offered the ideal framework: product flexibility and tax advantages.

However, like all retirement solutions, it should not be forgotten that savings will only be available at the time of retirement.

However, when we take a closer look at the product, we quickly see the many advantages.

The solution is flexible and adapts perfectly to the life of a self-employed person: income fluctuating over the years, payment flexibility, little time to devote to administration...

"I started to make enquiries with insurance companies in the Grand Duchy, explains Maria, a physiotherapist. I was pleasantly surprised by the flexibility in the products offered, adapted to the needs of self-employed people who can be very different from each other. "

Would you prefer to opt for fixed or complementary payments? Are you the sort of person who isn't afraid to take risks to get better returns or do you prefer safe investment?

A tax component that is more than favourable

Just like for employees, the law intends to provide the self-employed and liberal professions with tax benefits.

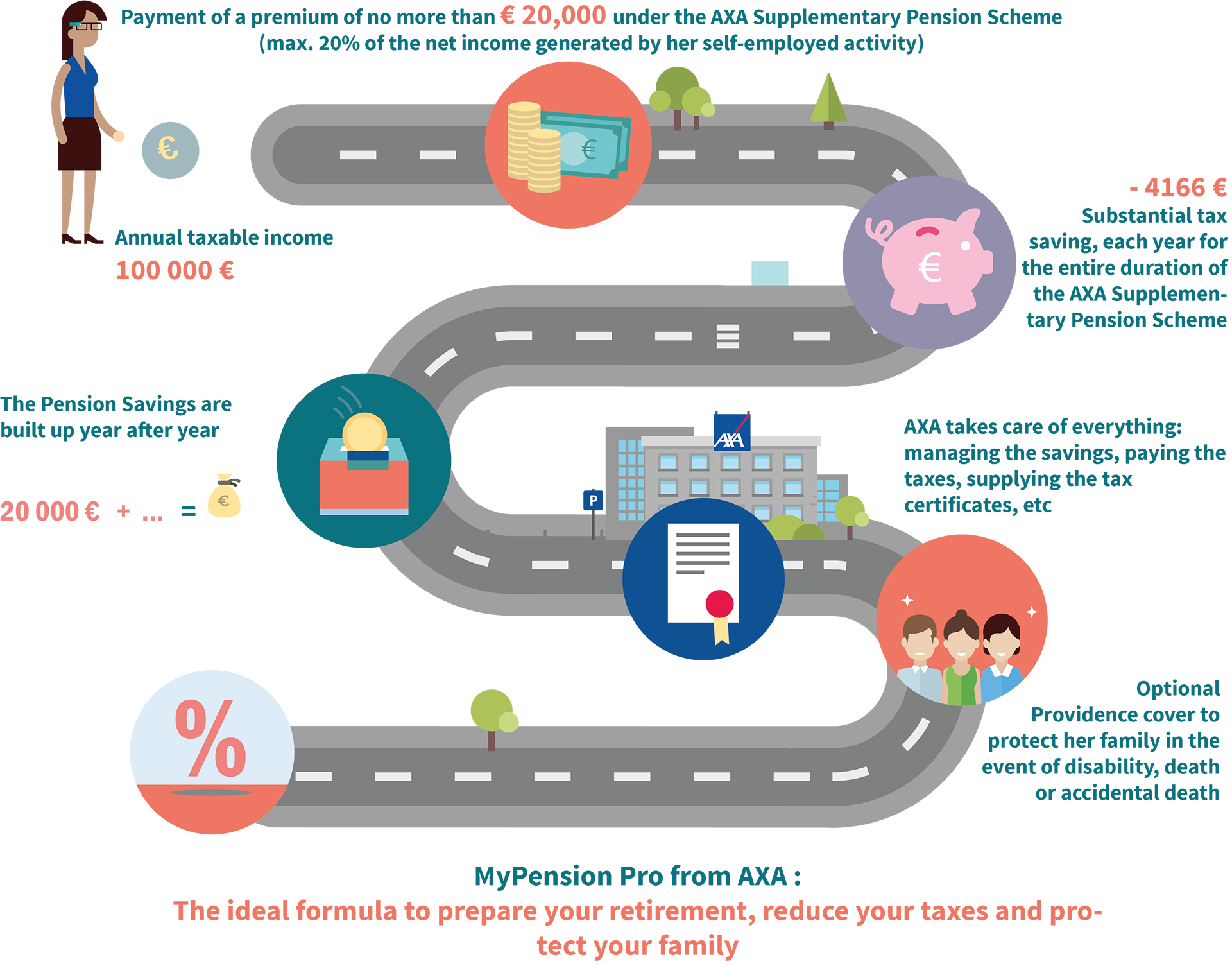

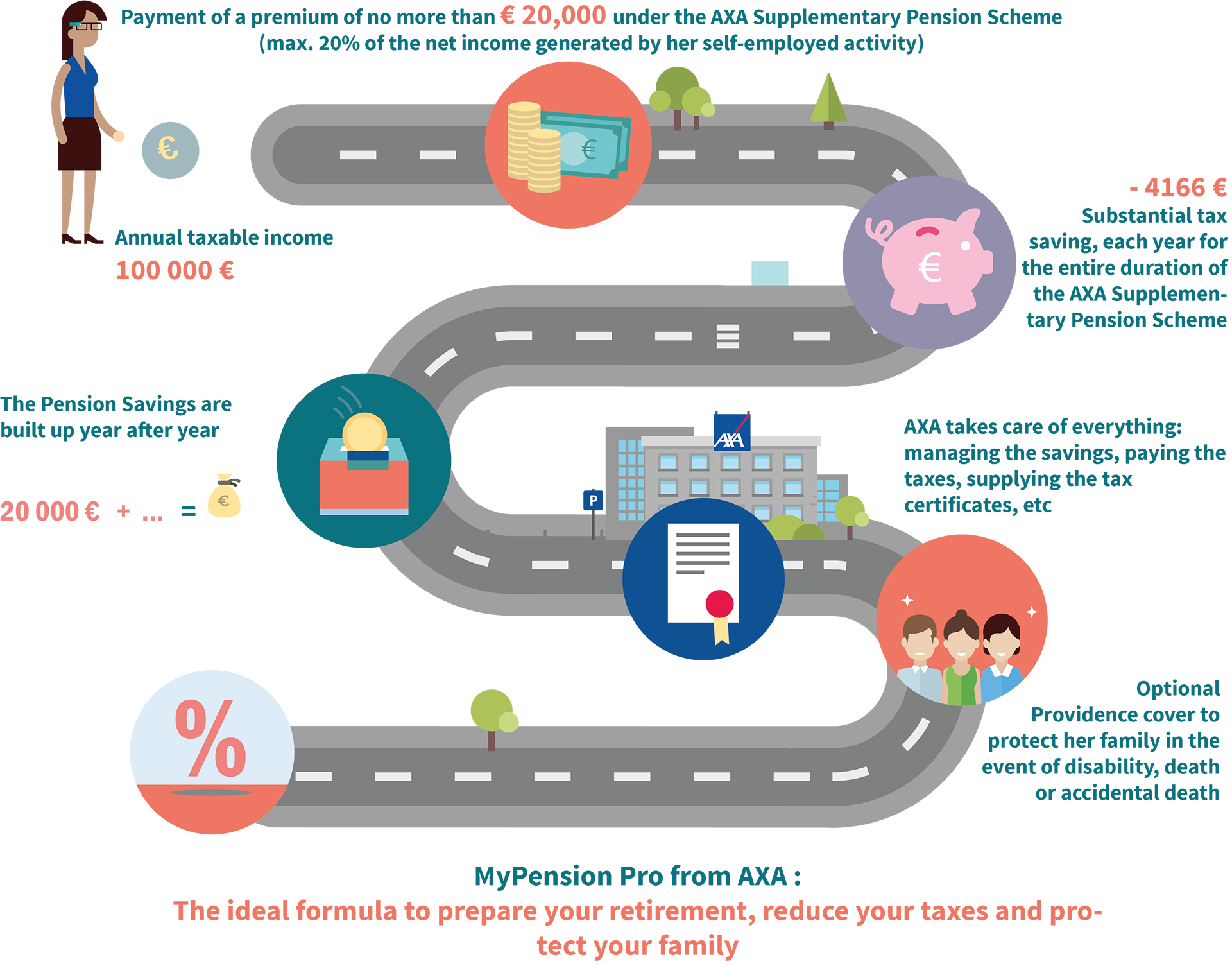

The premium paid by the member and earmarked for the financing of the Retirement Plan is tax-deductible as a Special Expense equal to 20% of the annual taxable income.

A discharge tax is payable on each premium but in return there is no taxation when the money is withdrawn!

A flat tax of 20% (instead of for example a 42% marginal tax rate) represents a significant tax benefit, and this happens for each payment.

The amount of capital you receive when you retire will no longer be subject to income tax in Luxembourg.

Only the social contribution to care insurance (currently 1.4%) will remain due and will be deducted when the pension benefit is paid.

As a complete product, the Supplementary Pension Scheme also allows the protection of loved ones in case of hardship

Individuals who are self-employed are very often the main source of income for their household.

It is therefore important for them not to neglect the protection of their loved ones in the event of a significant life event.

It is often a duty for them to anticipate an accident, death or disability that forces them to reduce their professional activity.

In addition to retirement benefits, supplemental pension schemes offer additional guarantees to enable families to maintain their quality of life in the event of hardship. These premiums are also tax deductible and unlimited.

"This supplementary pension plan will allow me to take full advantage of my future retirement. I’m protecting my family and save money by paying less tax. This is a reform I have been waiting for a long time! " concludes Catherine, an architect in the Grand Duchy.

It's easier with an example:

Contact a professional in the sector

An advisor is available in every region of the Grand Duchy to offer you his services and his well-informed advice about insurance solutions : Do you need advice ?