Save for your pension while paying less taxes

A Supplementary Pension Scheme for the Self-Employed and Liberal Professions

Liberal Professions

· Doctors, Dentists, Pharmacists, Nurses · Psychologists, Psychiatrists · Physiotherapists, Osteopaths, · Veterinarians

Self-Employed

· Freelancers, Lawyers, Notaries, Bailiffs · Architects, Real Estate Agents, Accountants

Craftsmen and Traders

· Craftsmen, Traders, Farmers, Liberal Professions · Other ...

MyPension Pro

With MyPension Pro, boost your pension and enjoy the tax benefits right now

MyPension Pro allows self-employed and liberal professions to save during your working life while enjoying tax benefits.

It is your guarantee of a reassuring a nest egg at retirement.

Advisers at your service

MyPension Pro, a highly-attractive Pension and Providence solution for the self-employed and liberal professions

👉 Self employed pension savings

Constitution of a supplementary pension capital for the self-employed and liberal professions

👉 The Tax relief

Significant fiscal advantages: the premium paid by the Insured that goes into the financing of the Pension Plan is tax-deductible

👉 Administrative simplicity

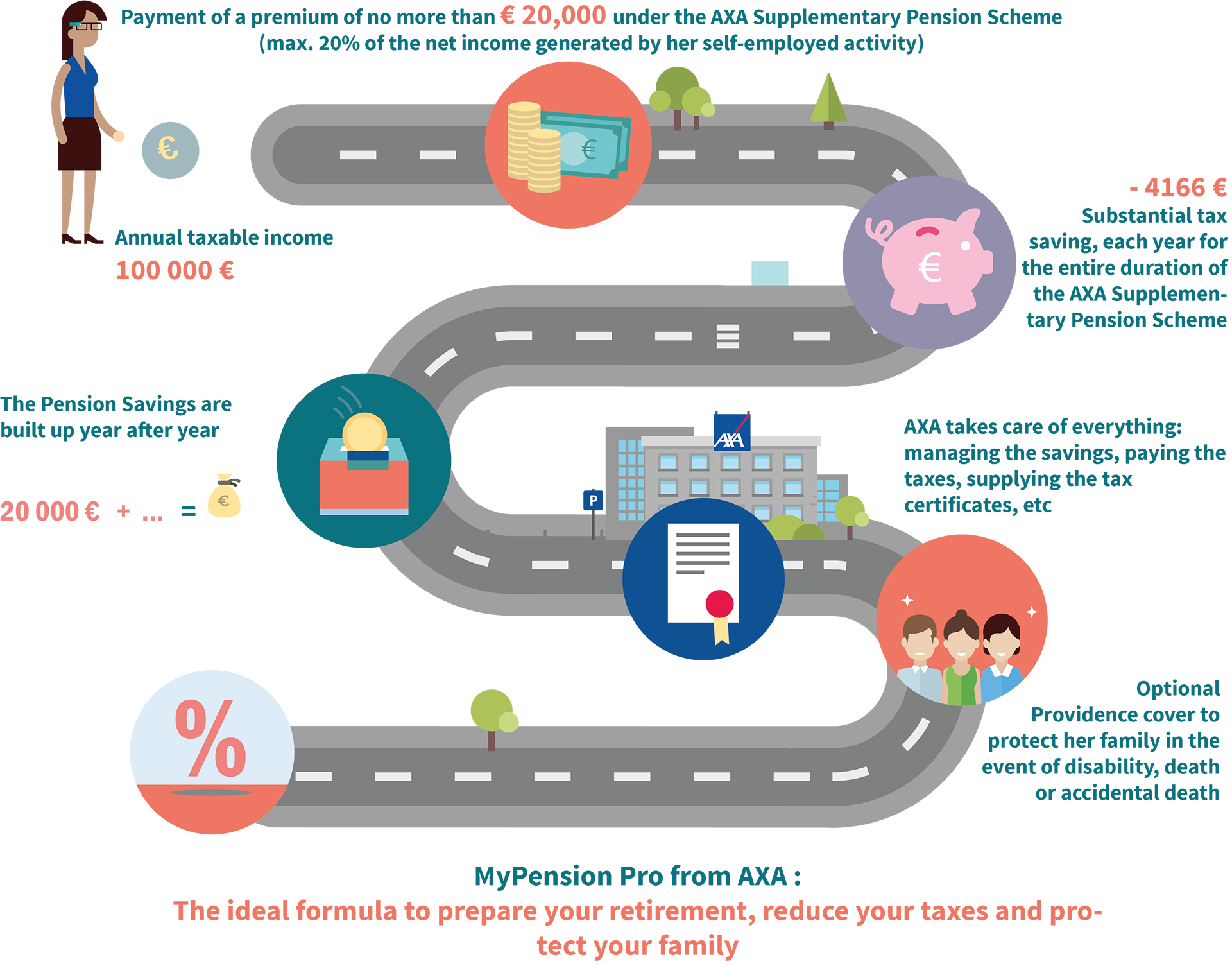

AXA takes care of all administrative and tax formalities, all you have to do is pay your premiums.

👉 Flexibility

Customisable and flexible solution also during the contract term: choose the options according to your needs: Accident, Disability and Death, and adapt them if your situation evolves. Invest also according to your risk appetite: savings can be 100% secure or more dynamic with AXA funds. Supplementary premium can also be invested before the end of each fiscal year to maximize the fiscal advantage

👉 Providence

Additional protection for your family and your income is available as an option offering cover in case of accident, disability or death. The Providence benefits allow your family to maintain its quality of life in case of unforeseen circumstances and, in addition, these premiums are fully deductible

Significant fiscal advantages:

The premium paid by the Insured that goes into the financing of the Pension Plan is tax-deductible as a Special Expense up to 20% of the annual taxable income.

A withholding tax is payable on each premium but, in return, no tax is due upon maturity! A flat-rate tax of 20% instead of, for example, a 42% tax at the marginal rate represents a significant tax relief, and applies to each payment.

The total capital you receive when you take your retirement will no longer be subject to income tax in Luxembourg, only the social contribution to fund the care insurance system (currently 1.4%) will remain due and will be deducted upon payment of the retirement benefit.

Advisers at your service

A simple illustration:

Anne is single. She is 30 years old and works as a self-employed lawyer. She would like to save every year for her retirement by taking advantage of the Supplementary Pension Scheme that is now extended to the self-employed and the liberal professions.

Let's see how she saves for her retirement while paying less taxes.

👉 1. Deduction of premium

Every year, she is eligible for a substantial tax relief because she can deduct her premium from her taxable income as a Special Expense (max 20% of the income corresponding to her self-employed activity).

👉 2. Tax savings

Her taxable income is therefore lowered by € 20,000, which also means lower taxes. Her tax gain amounts to € 4166.

👉 3. AXA takes care of everything

AXA takes care of collecting a 20% tax as well as a 0.9% regulatory tax on the insurance premium on behalf of the Tax Administration.

*The flat tax and the regulatory tax are set by law and may vary over time. These amounts are not tax-deductible as special expenses.

Advisers at your service

Optional Providence cover to protect you and your family

How to protect your family and your income as an independent?

Have you anticipated an accident, death or disability forcing you to cut back on your professional activity?

Death cover

To protect your family in the event of untimely death

Accidental death cover

To protect your family in the event of untimely death caused by an accident

Disability cover

To protect yourself against the consequences of a disability

Providence premiums are fully tax deductible, with no imposed ceiling

You can take out additional cover to allow your family to maintain its quality of life if unexpected circumstances arise and, what’s more, these premiums are tax deductible with no imposed ceiling.

Advisers at your service