How does the no-claims bonus system work in car insurance?

In auto insurance, the no-claims-bonus system is designed to reward good driving behaviour and sanction bad behaviour.

A portion of your premium (the premium linked to the Third-Party Liability cover and, in some cases, the premium linked to the Material Damage cover) is calculated according to your no-claims-bonus level.

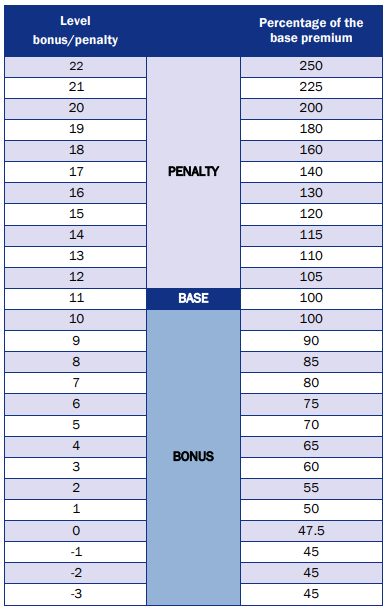

The highest level is 22 and the lowest is -3:

The basic no-claims-bonus level is 11; it's the one we apply to you when you have no history of auto insurance (so if this is the first time you insure a vehicle), or if you insure an additional vehicle (because you cannot duplicate levels acquired on other vehicles).

Over the years, the level evolves:

- If you did not have an accident for which you are responsible during the year, your level decreases by 1 point, which can lower your premium the following year (see diagram above).

- Conversely, a penalty is applied when you have had an accident for which you are responsible (+3 points), which increases your premium.

Remember that your level stays the same even if you change insurer.

If your old policy is terminated, you just have to ask for a no-claims-bonus certificate from your former insurer for the new insurer to apply the same level.

At AXA, we make a distinction between two no-claims-bonus systems:

- The “Third-Party Liability” system, related to accidents you cause to a third party (managed by legal provisions applicable to all insurers)

- The “Material Damage” system, related to accidents involving damage to your bodywork (only applicable under the formula OptiDrive Privil?g>?ge).

According to your formula, these levels are indicated on each of your bills, to help you follow the evolution of your premium.